Why Airplane Renters Insurance is a No-Brainer (by Lou DiVentura CFI 10-Year FAA Certified Flight Instructor)

After flying for over 20 years in the skies above New Jersey, I've witnessed firsthand the unexpected events that can occur in aviation. The NTSB database is a sobering reminder of the potential for accidents, ranging from minor mishaps to tragic incidents.

For example, the NTSB has documented numerous cases of:

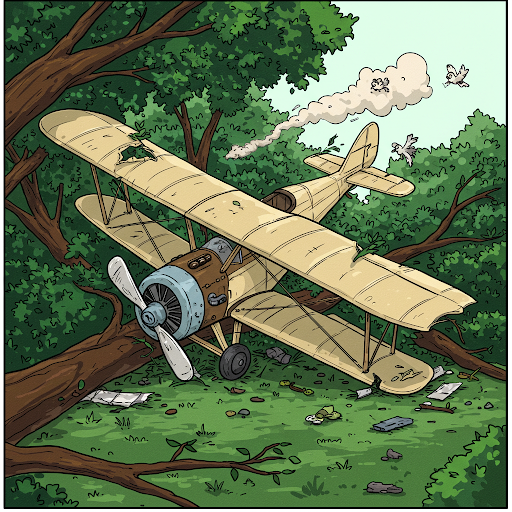

- Ground mishaps: Collisions with ground vehicles, objects, or terrain during takeoff or landing.

- Engine failures: Unexpected engine malfunctions that can lead to forced landings or even crashes.

- Loss of control: Incidents where pilots lose control of the aircraft due to various factors, including weather, mechanical issues, or pilot error.

These incidents, while thankfully not always resulting in serious injuries, can have significant financial consequences for both the pilot and the aircraft owner.

Renters insurance specifically designed for aircraft provides crucial protection against these unforeseen events:

- Accidental Damage: Covers the cost of repairs for damage to the rented aircraft, from minor dents and scratches to more substantial repairs.

- Third-Party Liability: Protects you from financial liability if you accidentally cause damage to another aircraft, property on the ground, or injure someone.

- Medical Expenses: Helps cover medical costs for yourself and any passengers in the event of an accident.

I've seen firsthand how quickly a minor incident can escalate into a major financial burden. Without renters insurance, you could be facing thousands of dollars in repair costs, legal fees, and medical bills.

Here's the bottom line:

Renters insurance is an affordable and essential safety net for any pilot who rents an aircraft. It provides peace of mind knowing that you're protected from unexpected events and allows you to focus on enjoying the thrill of flight.

Don't wait for an accident to happen. Contact your insurance agent today to discuss your renters insurance options.

AOPA, the Aircraft Owners and Pilots Association, offers competitive renters insurance policies specifically tailored to the needs of pilots.

Pricing for renters insurance can vary depending on factors such as the pilot's experience, the type of aircraft, and the coverage limits.

Basic liability coverage: Typically starts around $60 to $100 per year.

Comprehensive coverage: Including liability, hull coverage, and passenger injury, can range from $250 to $500 or more per year.

"This article was generated using Gemini AI and then reviewed and edited by Lou DiVentura"

Disclaimer: This article is for informational purposes only and does not constitute professional insurance advice. Please consult with a qualified insurance agent for personalized guidance and accurate pricing information.

Write a comment